Setting up Tax

In Order to set up tax, first of all there are certain external dependencies which will be done.

External Dependencies

Create First Party: Legal Entity and Establishments

Create Reporting and Collecting Tax Authorities

Create Reporting and Collecting Tax Authorities

Responsibility: Legal Entity Manager

Path: Legal Entity Manager -> Legal Entities -> Create Legal Entity

Use the Legal Entity Configuration to setup the following entities:

-First Party Legal Entity (that represents your company)

-First Party Legal Establishment (for each office, service center, warehouse and any other location within the company that requires a registration with a tax authority for one or more taxes). Setup associations between each legal establishment and a business entity.

-Legal Authority (for each tax authority that administers taxes in a tax regime where you do business)

Path: Legal Entity Manager -> Legal Entities -> Create Legal Entity

Use the Legal Entity Configuration to setup the following entities:

-First Party Legal Entity (that represents your company)

-First Party Legal Establishment (for each office, service center, warehouse and any other location within the company that requires a registration with a tax authority for one or more taxes). Setup associations between each legal establishment and a business entity.

-Legal Authority (for each tax authority that administers taxes in a tax regime where you do business)

Set The Profile Options

Set the following profile options as appropriate

eBTax: Allow Ad Hoc Tax Changes

eBTax: Allow Manual Tax Lines

eBTax: Allow Override of Customer Exemptions

eBTax: Allow Override of Tax Classification Code

eBTax: Allow Override of Tax Recovery Rate

eBTax: Inventory Item for Freight

eBTax: Invoice Freight as Revenue

eBTax: Read / Write Access to GCO Data

eBTax Taxware: Service Indicator

eBTax Taxware: Tax Selection

eBTax Taxware: Use Nexpro

eBTax Vertex: Case Sensitive

eBTax: Allow Manual Tax Lines

eBTax: Allow Override of Customer Exemptions

eBTax: Allow Override of Tax Classification Code

eBTax: Allow Override of Tax Recovery Rate

eBTax: Inventory Item for Freight

eBTax: Invoice Freight as Revenue

eBTax: Read / Write Access to GCO Data

eBTax Taxware: Service Indicator

eBTax Taxware: Tax Selection

eBTax Taxware: Use Nexpro

eBTax Vertex: Case Sensitive

Responsibility: System Administrator

Navigation: Profile -> System

Tax Configuration

Tax Configuration Comprises of the following

· Create Tax Regimes

· Create Tax

· Create Tax Status

· Create Tax Jurisdictions

· Tax Rate

· Tax Rules

Create Tax Regime

Responsibility: Tax Manager

Path: Tax Managers -> Tax Configuration -> Tax Regime -> Create

Prerequisites:

-Set up Legal Entities and Operating Units

-Enable currencies

-Design TCA Geography Hierarchy Structures (if required by the country)

-Set up Party Tax Profiles

-Optional: Set up tax zones, exchange rate types and tax authorities

All the mandatory fields are pointed with asterisk (*)

1) Write the Tax Regime Code.

2) Write the name of Regime.

3) Select the country name.

4) Give the effective from date.

5) There are certain tax controls and defaults available enable the options that you want to use.

Regimes

1

2

3

Taxes

Set up details of the taxes within a tax regime. A tax includes:-Configuration owner

-Default values from the tax regime

-Values specific to the tax

-Settings for tax accounts, tax exemptions, tax exceptions

-Settings for tax recovery, where applicable

Prerequisites:

-Set up a tax regime

-Optional set up ledgers and accounts, tax reporting codes and tax types (lookups).

Responsibility: Tax Manager

Navigation: Tax Managers -> Tax Configuration -> Taxes -> Create

3) Enter the Tax Source.

4) Enter Tax and Tax name.

5) Give the effective from date.

6) Choose the geography type parent geography type if any and the geography name.

7) Select the tax currency.

8) All the other details are optional.

9) At this stage do not make tax available to transaction. This would be last step after completion of all set up steps.

Set the controls and defaults as appropriate.

Tax Statuses

Create a tax status for a combination of tax regime, tax and configurator owner.Define all applicable tax rates and their effective periods under the tax status.

The tax status controls the defaulting of values to its tax rates.

Prerequisites:

-Set up taxes

-Optional, set up tax reporting types

Responsibility: Tax Manager

Path: Tax Managers -> Tax Configuration -> Tax Statuses -> Create

Status

1) Select the Tax Regime Code you have already defined.

2) Select the configuration owner.

3) Select the tax already created.

4) Enter the Tax Status Code and its name.

5) Give the effective from date.

6) All the other fields are optional.

7) Set the default controls as required.

Tax Recovery Rate

Path: Tax Managers -> Tax Configuration -> Tax Recovery Rate > Create

1) Create the Tax Recovery Rate.

2) Enter the Tax Regime Code Already created.

3) Select the configuration owner.

4) Select the tax created.

5) Enter the recovery rate code.

6) Enter the percentage recovery rate.

7) Enter the effective from date.

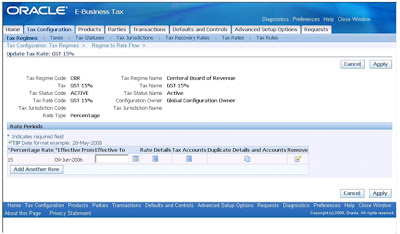

Tax Rates

Create tax rate records for tax statuses and tax jurisdictions.For tax statuses, set up a tax rate record for each applicable tax rate that a tax status identifies.

For tax jurisdictions, set up tax rate records to identify the tax rate variations for a specific tax within different tax jurisdictions. For example, a city sales tax for a state or province may contain separate city tax jurisdictions, each with a specific rate for the same tax. You can also define tax recovery rates to claim full or partial recovery of taxes paid.

Prerequisites:

-Set up tax status

-Set up units of measure (for quantity rate types)

-Optional, set up tax transaction type lookup codes, an offset tax, tax jurisdictions, tax reporting types, tax recovery rates, primary and secondary tax recovery types and tax recovery rules.

Responsibility: Tax Manager

Path: Tax Managers -> Tax Configuration -> Tax Rates -> Create

Tax Rate

1) Enter the tab create.

2) Enter the tax Regime Code.

3) Select the Configuration Owner.

4) Select the Tax and Tax status already created.

5) Select the tax jurisdiction code.

6) Enter the percentage rate of the tax.

7) Enter the effective from date.

Tax Rules

Although tax rules are optional but you have to create your own rules or active the default rules.

Path: Tax Managers -> Tax Configuration -> Tax Rules -> Create

Rule

1) Select the Configuration Owner.

2) Select the tax regime code.

3) Select the Tax already created.

4) Select the rule type, if you have not defaulted the rules in default and controls then you can default them from this window.

5) Select the rule type from the list of menu which you want to make default or want to create your own.

Tax Availability

Navigation: Tax Managers -> Tax Configuration -> Taxes -> Create

1) Tax will be available to transaction when all the above steps are completed

2) When you enable the checkbox; tax will be available for transaction.

3) Now you can use the above created tax in AP and AR

4) Make tax available

No comments:

Post a Comment

Please review my topic and update your comments

Note: only a member of this blog may post a comment.